Quick Verdict: A History of Red Flags

Is Oliver Velez Legit? Oliver Velez is one of the most famous names in day trading education, currently running iFundTraders.

While he markets a "risk-free" path to professional trading, documents provided to us suggest a troubling history.

This includes a 2007 termination letter from Pristine Capital Holdings alleging unauthorized use of corporate funds and a $252,000 debt.

Furthermore, recent whistleblower reports from Latin American traders allege that iFundTraders utilizes hidden fees and "simulation" traps to deny payouts. We advise extreme caution.

----

If you are looking into proprietary trading firms, you have likely come across Oliver Velez. With his flashy style and promises of "fully funded" accounts, he targets aspiring traders—particularly in Latin America—promising them a career on Wall Street without risking their own capital.

However, behind the "Master Trader" persona lies a trail of documented financial disputes, allegations of unpaid earnings, and questions about whether his wealth comes from trading or from selling the dream of trading.

The "Risk-Free" Promise vs. The Reality

The core of the Oliver Velez / iFundTraders pitch is that the firm takes all the risk.

According to the iFundTraders FAQ: "The firm does not profit unless you profit... If you lose and call it quits, all the losses are the firms."

In a video promotion (Minute 44:30), Oliver Velez states verbatim:

"You will never have to risk a single penny of your family's money if this doesn't work... if you lose my money, it's my fault... I will take the loss, you never have to pay me back."

Wondering if Oliver Velez from iFundTraders is a scam artist? Watch my Oliver Velez review in the YouTube video below to find out exactly why this guy is a fraud.

The Alleged Reality:

We have received documentation from traders, including Jose Luis Placid, alleging that this "risk-free" partnership is a mirage. The allegations suggest that:

Traders are placed in a video game simulation, not a real market.

When a trader reaches the "Live Account" stage, they are hit with unexpected desk fees and data fees to keep the account open.

Payouts are allegedly delayed or denied based on changing terms.

The "Junior" & Bill Deichler Emails

Evidence provided to BestStockStrategy includes communication with iFundTraders staff (specifically an employee named "Junior" and a manager named William "Bill" Deichler).

According to these reports, when traders attempt to withdraw their earnings, they are often met with silence or bureaucratic hurdles. One trader reported that despite the "partner" claim, his issues regarding debt and payouts were ignored, raising the question: Is iFundTraders a prop firm, or a fee-collection scheme?

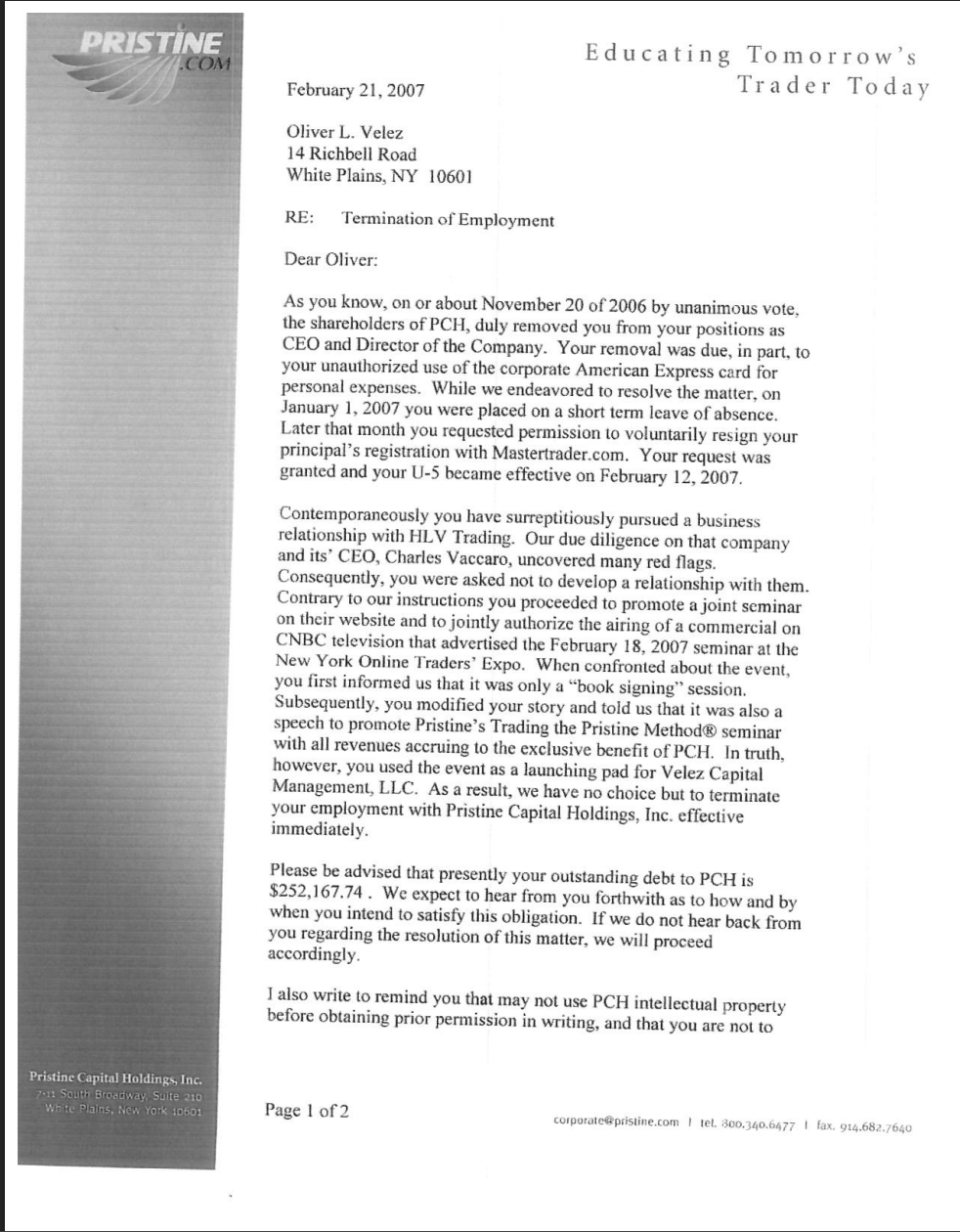

The "Smoking Gun": The 2007 Termination Letter

While Oliver Velez portrays himself as a disciplined financial master, a leaked document from his time at Pristine Capital Holdings (his previous company) paints a different picture.

We obtained a termination letter dated February 21, 2007, signed by Greg Capra (CEO of Pristine).

Documents provided to BestStockStrategy appear to show Oliver Velez's termination from Pristine Capital due to financial misconduct

Documents provided to BestStockStrategy appear to show Oliver Velez's termination from Pristine Capital due to financial misconduct

The letter states the following:

- Removal for Cause: Velez was removed as CEO due to "unauthorized use of the corporate American Express card for personal expenses."

- The Debt: The letter explicitly states: "Please be advised that presently your outstanding debt to PCH is $252,167.74."

- Deceptive Practices: The letter alleges Velez used a "book signing" event to surreptitiously promote a competing business venture.

Analysis: If a "Master Trader" was allegedly relying on corporate credit cards for personal expenses and owed his own company a quarter-million dollars, it casts serious doubt on his claims of consistent trading profitability.

Oliver Velez Net Worth: Marketing vs. Markets

Oliver Velez frequently flaunts a lifestyle of luxury vehicles and international travel. However, what is Oliver Velez's real net worth?

Based on the 2007 debt allegations and the business model of iFundTraders (which charges thousands for seminars and "funded" accounts), it is our opinion that his net worth is derived primarily from education sales, not trading profits.

Real prop firms profit from the market. "Pay-to-Play" prop firms profit from you failing the evaluation or paying monthly desk fees. The aggressive targeting of the Latin American market—where regulatory oversight is looser—suggests a business model focused on volume of students rather than quality of traders.

Oliver Velez Reviews: The "Simulation" Trap

External reviews and whistleblower emails suggest a pattern targeting international students.

The "Sim" Accusation:

A source, Jose Luis Placid, stated: "I am completely aware of this video game simulation, but they are playing with that to take money from others. Specifically, if you reach that 'live account' they ask money if you want to keep it, so they charge you fees... meanwhile account goes down."

This suggests iFundTraders may operate similarly to other "churn and burn" prop firms. You pay for a simulation. If you win, they create hurdles to avoid paying you (because the money likely isn't real). If you lose, they keep your education fees.

A Better Way: The "Financed Bull" Strategy

Do not pay thousands of dollars for a "simulation" account where the rules change when you win. You do not need a "guru" to trade for a living.

At BestStockStrategy, we teach the "Financed Bull" strategy. We trade real capital in real markets. By buying call debit spreads and financing them by selling naked puts on high-quality companies, you can participate in the upside for "free" while maintaining mathematically superior risk management.

Stop Playing Games. Start Winning.

Don't let hidden fees and simulation traps drain your savings. Learn a strategy that works in the real world.

Get the "Financed Bull" Strategy (14-Day Trial)

Click Here to Learn the Strategy (Win Up to 98% of Trades)

Consumer Resources & Protection

If you feel you have been defrauded by Oliver Velez, iFundTraders, or any "Pay-to-Play" prop firm, we recommend contacting the following authorities. Since iFundTraders operates internationally, U.S. agencies may still have jurisdiction if they market to U.S. citizens.

- CFTC (Commodity Futures Trading Commission): File a Tip or Complaint - The CFTC regulates prop firms and commodity pools.

- Federal Trade Commission (FTC): Report International Scams

- New York Attorney General: File a Complaint (Given his previous ties to NY-based Pristine Capital).

----------

In my opinion, Oliver Velez and iFundTraders.com is one of the biggest frauds in the industry and I believe that virtually all of Oliver Velez' students are likely to lose money by following him.

Others believe similar things (as found here on Reddit and this doc about his business practices).

Our Final Oliver Velez and iFundTraders Review

In my opinion, Oliver Velez, and his website iFundTraders, is one of the biggest frauds in the industry.

I believe that virtually all of his followers will lose money.

Frequently Asked Questions (FAQ)

Is Oliver Velez a Scam?

In our opinion, there are significant red flags regarding Oliver Velez. Documents from his previous partner, Greg Capra, allege he was terminated for unauthorized financial misconduct and debt. Recent user reports regarding iFundTraders allege unpaid earnings and hidden fees.

Does iFundTraders really fund you?

Many users allege that iFundTraders keeps traders in a "simulation" environment even after they "qualify" for a live account. This means your trades are likely not hitting the real market, and payouts come from the company's pocket—creating a conflict of interest where they only win if you lose (or if they refuse to pay you).

What happened to Pristine Capital Holdings?

Oliver Velez was terminated from Pristine Capital Holdings in 2007. A termination letter provided to us cites "unauthorized use of the corporate American Express card" and a personal debt to the company of over $252,000.

Is Oliver Velez a scam artist?

In my opinion, I believe that Oliver Velez is not legitimate and I would be surprised if he is a profitable trader.

Is iFundTraders legitimate?

Many people have complained that iFundTraders has stolen their money.

Oliver Velez Trading Review?

I don't believe that Oliver Velez is a profitable trader, and I do believe that virtually all his followers lose money.

Oliver Velez Course Review?

If your goal is to lose money, then taking Oliver Velez' course, or enrolling in iFundTraders.com is a great idea!