Quick Verdict: Is TJR Trades Legit?

While Tyler Riches (TJR Trades) is a popular influencer with a high net worth, our analysis suggests his wealth likely stems from marketing courses and affiliate fees rather than consistent day trading profits. Due to the lack of audited broker statements and the statistical improbability of his claims, we advise caution.

Best Alternative: Win Up To 98% of Trades (The Strategy)

If you spend any time on financial YouTube or TikTok, you have likely seen the screaming face of TJR Trades (real name: Tyler Riches). He presents himself as a 23-year-old multimillionaire who went from a "broke DoorDash driver" to a "Top Floor Boss" reportedly making $5,000 a day trading futures.

He sells a lifestyle of exotic cars, Miami mansions, and financial freedom. But is TJR Trades legit? Or does the reality of his business differ from the marketing?

After analyzing hours of footage, reviewing public tax records, and comparing his claims against peer-reviewed academic studies on day trading, legitimate questions arise regarding the source of his wealth and the viability of his strategies.

Here is our analysis of Tyler Riches, his alleged net worth, and why we believe caution is warranted.

The "Rags to Riches" Narrative vs. Public Records

TJR’s origin story is a classic marketing hook designed to make him relatable. He claims he was dead broke, in debt, and delivering food to survive until he "reprogrammed his mind" to master the markets.

Public tax filings for the Pinewood School (Creative Center of Los Altos) list Scott Riches as a key employee with significant compensation, which you can verify directly on ProPublica's Nonprofit Explorer.

According to nonprofit tax filings available to the public:

- His father, Scott Riches, serves as the President of the school, with public records showing compensation exceeding $500,000 annually.

- Other family members, including his mother and uncle, also appear on the payroll with significant salaries.

While coming from a wealthy background isn't a crime, it does contradict the "broke and desperate" marketing narrative used to sell his courses. Furthermore, in past podcasts, Tyler himself stated that his initial capital came from taking out a high-interest loan and betting it on Solana (SOL) during a crypto bull run.

In my opinion, this sounds less like disciplined day trading and more like a high-risk speculative bet that happened to pay off.

Similar to the allegations in our Warrior Trading review, rely on selling the dream rather than the reality.

The "Strategy": Does TJR Show Real Trades?

If you watch TJR’s "Live Day Trading" videos, you might notice a pattern common among online trading influencers. We were unable to find:

- Verified broker statements from a regulated US broker.

- Live entries and exits clearly executed on a DOM (Depth of Market) or regulated interface.

- An audited P&L (Profit and Loss) statement over a significant period.

The "Projection" Tool Concern

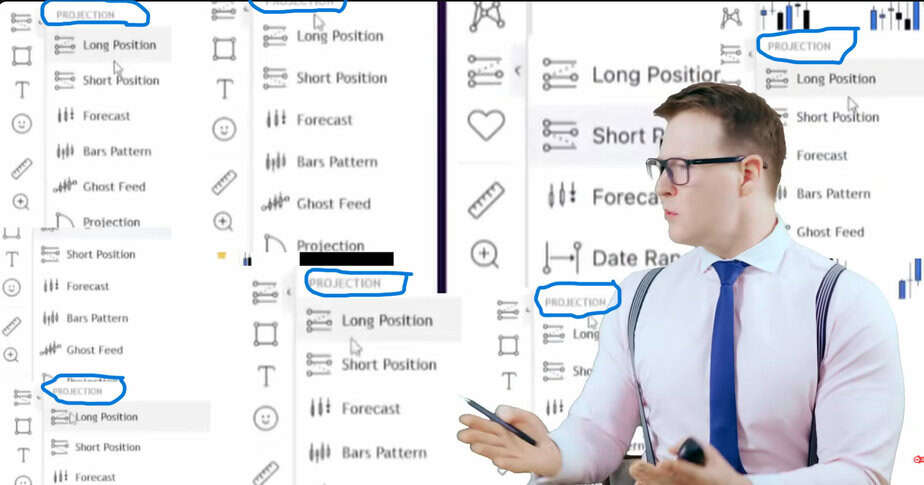

In many of his videos, observant viewers have pointed out that he appears to be using the "Long Position" and "Short Position" projection tools on TradingView rather than executing live trades.

Close inspection of his trading interface reveals that he often uses the 'Projection' tool rather than 'Open Position.' This suggests these trades may be simulated analyses (paper trading) rather than live capital at risk, creating a misleading impression of easy profits.

The ICT Connection

TJR’s strategy appears to be a repackaged version of "Inner Circle Trader" (ICT) concepts—utilizing terms like "Fair Value Gaps" and "Liquidity Sweeps."

It is our opinion that these concepts often unnecessarily complicate trading. Critics in the trading community have long questioned the validity of ICT concepts, noting that the creator of ICT has previously struggled to provide verified proof of profitability in live trading environments.

The Science: Why "Mindset" Advice Can Be Misleading

In a recent video titled "How I Reprogrammed My Mind to Make $5,000 Everyday," TJR suggests that losing traders simply lack the right discipline or vision.

In my view, this advice ignores the statistical reality of the markets. Academic research suggests that day trading failure is not about "mindset"—it is about the negative expected value of the activity itself.

The Brazil Study (Sao Paulo School of Economics)

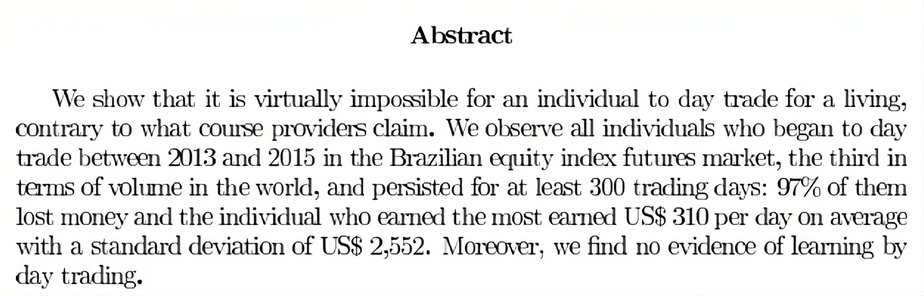

A comprehensive study titled "Day Trading for a Living?" analyzed nearly 20,000 day traders. The results contradict the idea that anyone can trade for a living simply by trying harder.

Abstract Text for Reference: "We show that it is virtually impossible for an individual to day trade for a living... 97% of them lost money, only 0.4% earned more than a bank teller... and we find no evidence of learning by day trading."

The study indicates that day trading performance does not improve with experience. Statistically, the more you trade, the more likely you are to lose.

The Taiwan Study (Barber, Lee, Liu, Odean)

Another massive study, "Do Day Traders Rationally Learn About Their Ability?", analyzed heavily active traders over a 15-year period. They found that less than 1% of day traders are predictably profitable after fees.

Given this data, selling the idea that "reprogramming your mind" will lead to $5,000 daily profits is, in my opinion, highly irresponsible.

The financial dangers of strategies like TJR's are well-documented. The SEC has issued explicit warnings stating that day traders 'typically suffer severe financial losses in their first months of trading.' Similarly, the FTC warns consumers to be skeptical of promoters claiming 'low risk' and 'high returns' in speculative markets."

1of1 Funding: Valid Prop Firm or Conflict of Interest?

TJR is also associated with a proprietary trading firm called 1of1 Funding.

This firm advertises a 100% profit split to traders. From a business perspective, this raises immediate questions. If a prop firm pays out 100% of the profit to the trader, how does the firm remain solvent?

The Business Model Concern:

Many industry watchdogs warn that firms offering 100% payouts likely operate on a model where revenue is generated primarily from evaluation fees paid by failing traders. This creates a potential conflict of interest: the firm may benefit more when traders fail their evaluations than when they succeed.

- Review Analysis: A look at their Trustpilot page shows a high number of 5-star reviews. However, upon closer inspection, many of these reviews appear to be posted in clusters on the same dates, leading some observers to question their authenticity.

TJR Trades Net Worth: An Alternative Explanation

If the academic data suggests it is nearly impossible to make $5,000/day consistently from trading, how does TJR afford his lifestyle?

In my opinion, TJR is likely an incredibly successful marketer. Based on his subscriber count (approx. 1 million) and standard industry conversion rates, his revenue likely comes from selling the dream of trading, rather than trading itself.

Estimated Revenue Streams:

- Course Sales: With a price point around $4,000, signing up even a small fraction of his audience could generate millions annually.

- Affiliate Marketing: Promoting unregulated crypto exchanges and prop firms often carries high commission payouts.

- YouTube Ad Revenue: His "wealth lifestyle" content garners millions of views, likely generating substantial ad revenue.

- Subscription Services: Recurring revenue from Discord access and indicator bundles.

It is highly probable that Tyler Riches is a multimillionaire—but the evidence suggests this wealth was built by selling products to aspiring traders, not by beating the S&P 500.

The 1of1 Funding Controversy & ICT Strategy

TJR heavily promotes 1of1 Funding, a proprietary trading firm. However, recent user reports and Trustpilot reviews indicate serious concerns regarding payouts. Many traders allege that prop firms like this generate revenue primarily from failed evaluation fees rather than successful trading. If 1of1 Funding becomes insolvent or refuses payouts, traders have little recourse.

Furthermore, TJR's strategy relies on 'Smart Money Concepts' (ICT). While popular on social media, ICT is controversial in the professional community, with many critics noting that it is simply rebranded technical support/resistance with no statistical edge. Relying on these unproven concepts—combined with a risky prop firm—is a dangerous recipe for beginners.

Conclusion: Is TJR Trades Legit or High Risk?

While we cannot classify TJR Trades as a scam in the legal sense, his marketing methods raise significant red flags regarding consumer protection. The combination of lifestyle marketing, lack of audited broker statements, and promotion of high-risk prop firms suggests a business model prioritized around course sales rather than student success. Users should exercise extreme caution.

The academic data is clear: day trading is statistically similar to gambling. When an influencer tells you that your losses are your fault because you haven't "reprogrammed your mind," they are keeping you in the game—and potentially collecting fees from your participation.

In my opinion, you should not buy his course or join 1of1 Funding.

If you want to build wealth, do not gamble on direction like TJR. Instead, consider buying call debit spreads financed by selling naked puts.

This strategy allows you to capture unlimited upside on great companies (like buying Calls) but you finance the cost by selling puts at a price where you'd be happy to own the stock anyway.

It provides a mathematical edge that day trading cannot match.

Disclaimer: The opinions expressed in this article are based on the author’s research of public records, social media content, and academic studies. This content is for educational and entertainment purposes only and does not constitute financial or legal advice. The author has no personal knowledge of TJR Trades' private financial records.